2021-12-27

The new era of "individual pension" has been fully opened

Writer: Views: 709

Many insiders believe that the introduction of the central document indicates that the third pillar "personal pension" has entered a new stage of development and will also fully open a new era of "personal pension" in the financial field.

Central document issued

The third pillar has entered a new stage of development

The meeting stressed the need to promote the development of individual pensions suitable for China's national conditions, government policy support, individual voluntary participation and market-oriented operation, and link up with basic old-age insurance and enterprise (occupation) annual pension, so as to realize the supplementary function of old-age insurance.

The meeting stressed that developing a multi-level and multi pillar old-age insurance system is an important measure to actively respond to the aging population and realize the sustainable development of the old-age insurance system. We should improve the system design, reasonably divide the pension responsibilities of the state, units and individuals, and provide institutional guarantee for individuals to accumulate pensions. We should strictly supervise and manage, improve supporting policies, and quickly clarify implementation measures, fiscal and tax policies and financial product rules, so that people can understand, understand and operate well, so that all parties involved have rules to follow, system operation can be monitored and tested.

"The above documents can be said to be the top-level design documents for the construction of the third pillar of pension. Its implementation will undoubtedly push the development of China's pension security system and pension financial industry to a new peak." Huaxia Fund stakeholders said that the development of the third pillar personal pension is of long-term and positive significance for China to build a multi-level and multi pillar pension insurance system, deal with the pressure of aging, improve the pension treatment level of all citizens, and optimize the capital market structure.

"This indicates that the third pillar of the old-age security system will enter a new stage of development." Harvest Fund stakeholders also said that with the gradual introduction of China's individual pension policies and relevant guidance, it is conducive to further integrate forces in different fields, comprehensively build a more effective pension three pillar system, especially give further play to the positive role of the individual pension system.

Zhu Xingliang, deputy director of fof investment and Financial Engineering Department of Xingzheng Global Fund, also said that the introduction of the opinions is a powerful measure for the party and the state to promote the development of individual pensions from the central level.

Huitianfu fund also pointed out that this is the first time that the central government emphasizes the important role and supplementary pension function of individual pension, and integrates individual pension reserves into China's pension system for long-term investment and accumulation through policy support, product innovation and system guarantee.

Gao Ying, pension investment director of Ping An fund, also believes that this move is good news for the development of pension target funds: on the one hand, preferential tax policies can stimulate investors to develop the habit of fixed investment and help investors establish the concept of pension investment; On the other hand, the development of the third pillar retirement pension is also a benchmark event.

"The introduction of the above policies will help to open a new era of personal pension in the financial field." Yao Hui, senior fund analyst of Shanghai Securities Fund Evaluation and Research Center, also said that the introduction of the policy is unprecedented and the implementation is expected to be in direct proportion. The pilot in the fields of banking, insurance and funds in the early stage will also provide experience and confidence for the all-round implementation of the development of personal pension.

According to the interpretation of many people in the industry, the reform, development and innovation of China's financial market are greatly related to the promotion of policies.

As early as 2018, the Ministry of finance, the State Administration of Taxation, the Ministry of human resources and social security, the China Banking and Insurance Regulatory Commission and the China Securities Regulatory Commission issued the notice on carrying out the pilot of individual tax deferred commercial endowment insurance, which was piloted in Shanghai, Fujian and Suzhou Industrial parks; The guidelines on pension target securities investment funds issued by the CSRC opened the prelude to pension fof; In September this year, the China Banking and Insurance Regulatory Commission issued the notice on carrying out the pilot of pension financial products, and the hot sale of pension financial products hit the headlines in December; ***

It is urgent to make up for the shortcomings of the third pillar

The introduction of the policy coincides with the time

According to the analysis of many insiders, in order to meet the challenges of aging society and improve national pension treatment, the introduction of the third pillar "personal pension" is urgent and necessary, and the introduction of policies is also at the right time.

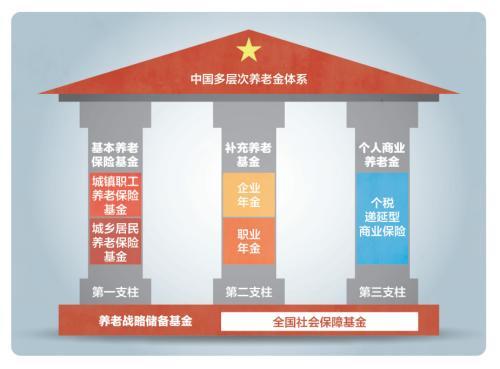

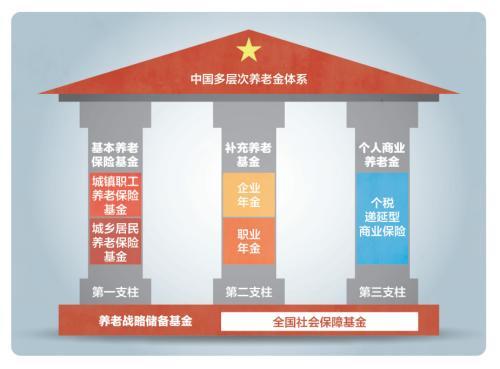

Gao Ying said that with the development of the global population aging trend, the three pillar model has become a common trend in the reform of pension systems in various countries: the first pillar is the basic pension paid by the government; The second pillar is enterprise annuity and occupational annuity; The third pillar is individual tax deferred pension. At present, in China's three pillar pension security system, most retirees have no supplementary pension such as annuity except the basic pension provided by the government.

"In the long run, neither the mandatory first pillar nor the voluntary second pillar can provide sufficient and effective old-age security for all citizens." Gao Ying said that China's aging trend is serious. At present, the first pillar of the three pillar pension structure is the largest. The "pension replacement rate" that can be provided in the future is expected to show a downward trend. There is an urgent need to launch a supplementary pension based on "personal pension", so as to provide reserves for future pension and improve the quality of life after national retirement.

Both Huaxia and Harvest Fund said that actively responding to population aging has become a national strategy, and accelerating the improvement of the three pillar old-age security system is in a prominent position. To improve residents' pension security, there is an urgent need to speed up making up the short board of the third pillar personal commercial pension. The upcoming personal pension system is regarded as the key to making up the short board.

Huitianfu fund also believes that the introduction of "personal pension" has the following positive effects: first, as a supplement to the national pension income, it can alleviate the problem of insufficient development in the pension field; Second, promote the transformation from savings pension to investment pension, and form a long-term pension plan; Third, optimize the national financial structure and promote the improvement of the capital market.

According to the analysis of huitianfu fund, from foreign experience, pension fund can become an important influence force in the capital market, and the mature and active capital market also provides a broad operation space for maintaining and increasing the value of pension fund. On the one hand, large-scale pension and other long-term funds are expected to become the cornerstone of the capital market, contribute to the prosperity of the capital market, and have strategic significance for accelerating the construction of a "double cycle" new development pattern; On the other hand, the capital market is of great significance for the sustainable operation of pension. After the implementation of market-oriented investment in pension, the investment income is often several times of the payment principal, which can improve the substitution rate of individual pension and the financial sustainability of the system, help to prevent old-age poverty and social stability, and become a "people's livelihood safety net".

Public data show that by the end of 2020, 998 million people had participated in and basic old-age insurance. Although the first pillar of basic old-age insurance has basically achieved full coverage, the overall security level is relatively limited; 105000 enterprises have established enterprise annuity, with 27 million employees. The coverage of the second pillar enterprise (vocational) annuity is still narrow, which can only meet the pension needs of a small number of groups; while the number of people participating in individual tax deferred commercial pension insurance in the pilot area is 48800.

According to the data of the National Social Security Fund Council, by the end of 2020, China's pension balance accounted for about 12% of GDP, of which the first pillar accounted for 62%, the second pillar accounted for 37%, and the third pillar accounted for a very low proportion, with serious uneven development.

According to the calculation, the replacement rate of China's current basic pension is 38%, which is far lower than the level of no less than 70% recommended by the world bank. If only relying on the basic pension, the living standard of the elderly may decline significantly in the future. Therefore, to improve residents' pension security, there is an urgent need to speed up the short board of the third pillar personal commercial pension.

"At this stage, it is of great significance to propose to vigorously develop the third pillar represented by 'individual pension'." Xing Zheng Global Fund Zhu Xingliang said.

Return